Macroeconomic Analysis: Unemployment and Inflation Case Study

Macroeconomics is a subbranch of economics that analyses economic activities and how they affect other economic factors. As such, it evaluates the performance, productivity, government expenditures, and interest rates within an economy to determine its well-being. Macroeconomic analysis on unemployment and inflation are two of the most important factors to consider while evaluating a country’s GDP growth. Unemployment can have a ripple effect throughout the economy, leading to higher inflation levels. And inflation can cause unemployment to rise as businesses struggle to keep up with rising costs. Unemployment rates have been on the rise, and inflation has been increasing. This has negatively affected the economy as a whole and the lives of millions of Americans. Several factors can contribute to high unemployment and inflation in the United States, such as economic recession, the skills gap, and social inequality. These many factors influence unemployment rates among young college graduates and African-Americans.

Need expert support with complex macroeconomics assignments? Our team provides professional economics homework assistance for case studies, research papers, and detailed analyses. At My Homework Helpline, we help you understand key economic concepts, improve accuracy, and submit high-quality work. Get reliable homework support today to excel in your studies.

Data On Unemployment Rates and Inflation

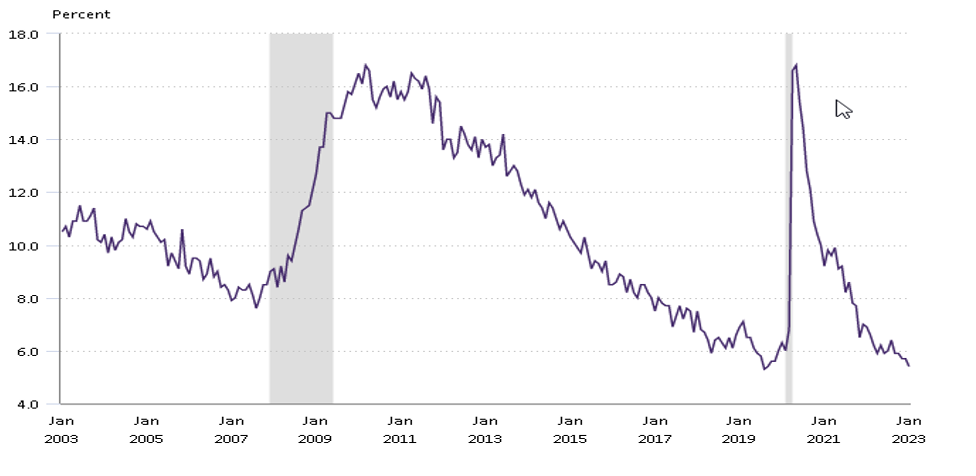

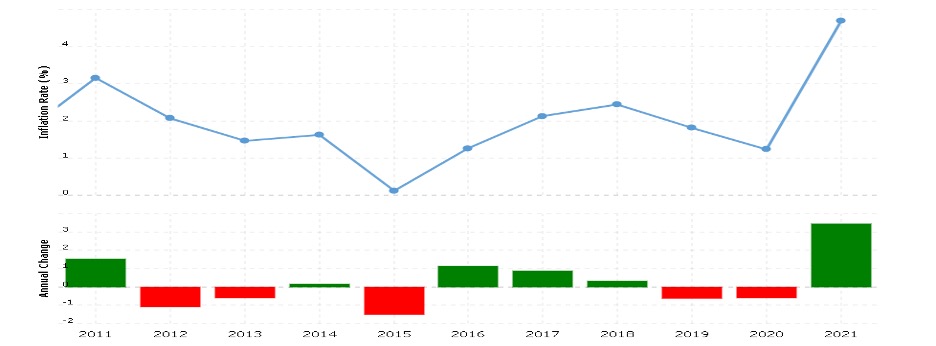

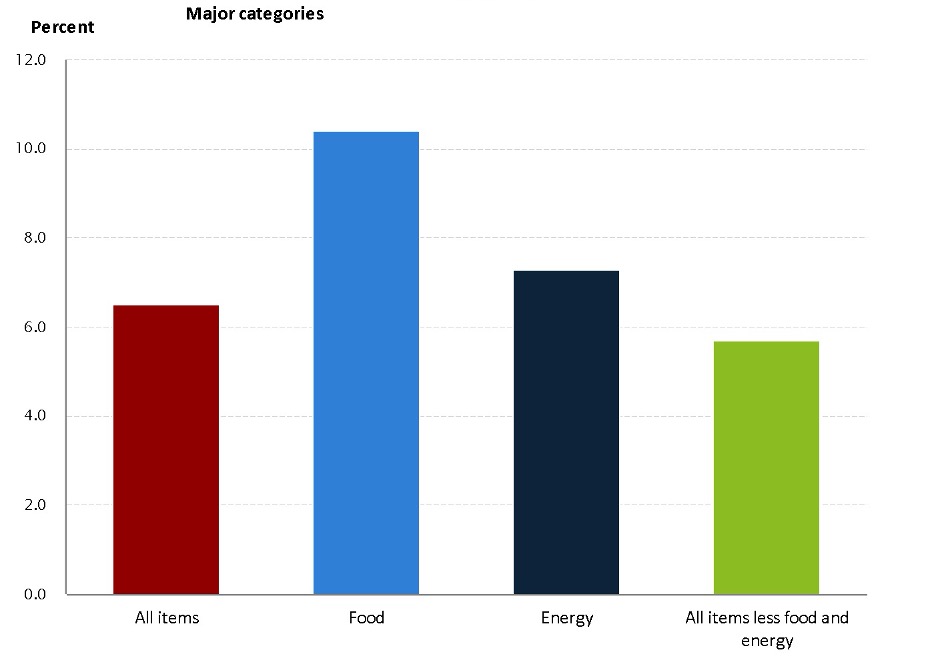

There is a clear correlation between unemployment and inflation rates in the United States. When the unemployment rate is high, the inflation rate also tends to be high. This is particularly true for young college graduates and African-Americans youths. In the last ten years, the GDP has grown tremendously even though inflation and unemployment still are challenges in the economy. This year, the growth rate of GDP is estimated at 1.4%, while the unemployment rate has increased by 50% from last year. The graphs and tables provided in the data section help to illustrate this point. In particular, the table on “Unemployment Rate vs. Inflation Rate (Based on College Graduates)” shows that when the unemployment rate is high, the inflation rate also tends to be high. The “Unemployment Rate vs. Inflation Rate (Based on African-American Youths)” table has similar findings.

Figure 1. Unemployment Rates Among the African-Americans (U.S. Bureau Of Labor Statistics, 2022)

Figure 2. United States Inflation Graph from 2011 to 2023 (U.S. Bureau Of Labor Statistics, 2022)

Figure 3. 12 Month Percentage Change, Consumer Price Index, Selected Categories, December 2022, Not Seasonally Adjusted (U.S. Bureau Of Labor Statistics, 2022)

Analysis of Unemployment and Inflation Rates in the U.S.

The unemployment rate for young college graduates is significantly higher than the national average, and this rate is even higher for African-Americans. The inflation rate for goods and services is also higher for African-Americans, which significantly impacts their quality of life. According to Kalsum et al. (2020), college graduates are mainly unskilled and inexperienced individuals seeking jobs in the employment market. Their lack of skills and experience has greatly influenced their high unemployment rates. Currently, the American economy is facing high inflation, leading many employers to seek to reduce their employees. As such, this has left young inexperienced college graduates and African-Americans unemployed. Last year, after the pandemic, the GDP dropped while many lost their jobs. Also, very few would secure employment at the time due to the restrictions. Even after the reopening, times were difficult as many college graduates had to stay unemployed for a long time. On the other hand, African-Americans in the United States are a minority group that faces several disparities, employment being one. There are a number of factors that contribute to these disparities, but further research is needed to determine the root cause. Nevertheless, these findings provide an important glimpse into the state of unemployment and inflation in the United States. The disparity between employers and lack of experience among college graduates has been catalyzed by inflation, thus leading to high unemployment rates.

Reflection and Critical Thinking

It is imperative to consider the factors that promote unemployment rates among young college graduates and African-Americans While reflecting and critically thinking about the relationships between unemployment and inflation in the United States. The knowledge and understanding of these causative factors make it easy for lawmakers and economists to strategize a solution. Axelrad et al. (2018) posit that high tuition costs make college unaffordable for many, making it difficult to get a degree and enter the job market while considering the impact of GDP on the economy. The GDP outlines the productivity of an economy. With the little growth, the GDP signified that racial bias imparts unequal opportunities to African-Americans, contributing to unequal distribution of wealth among different racial groups. Both factors contribute significantly to higher unemployment rates for college graduates and African Americans. Moreover, high levels of unemployment can lead to a decrease in purchasing power, which can lead to higher inflation rates, further contributing to economic instability in the United States. Technology advancement is also a factor that has influenced unemployment and inflation. Technology in the technical fields has replaced thousands of employment sports in the job market. Also, technology increases productivity and reduces the cost of production, thus reducing the costs of products and services thus, lowering inflation rates in the United States. Factors such as technology, high costs of highering graduates, and marginalization influence employment rates and inflation, and their knowledge can help strategize a solution.

Solutions and Recommendations

Solving the issues of unemployment and inflation in the United States requires a combination of macroeconomic policies. Expansionary fiscal and monetary policies are two of the most effective measures that can be used to stimulate economic growth, thus reducing unemployment and inflation rates in the United States. Bredin & Fountas (2018) outline that expansionary fiscal policy involves increasing expenditures by cutting taxes, which will increase consumer spending. This will increase demand for goods; also, the GDP will grow and thus boosting production and creating more jobs. On the other hand, expansionary monetary policy refers to increasing the money supply by reducing interest rates to spur economic activity. Lower interest rates will encourage investments, creating more jobs and increasing total output. This should help reduce unemployment among college graduates and African-Americans in the United States. Moreover, technology can be used to fight high inflation. The technology capitalizes on reducing the cost of production while increasing productivity. This way, the cost of products and services is significantly reduced, and thus inflation decreases. Also, the GDP will increase, and the economy will have the financial power to hire more college graduates while reducing inflation. Expansionary fiscal and monetary policies, as well as technology, can be used to solve the unemployment and inflation rates in the United States.

Conclusion

In conclusion, analyzing the data from the past 10 years, it is evident that a number of factors contribute to high levels of unemployment and inflation in the United States. Unemployment rates are highest amongst young college graduates and African-Americans, and inflation rates are highest when GDP growth is low. It is important to address these challenges to promote stable economic growth in the United States. Macroeconomic policies can be used to strategize how to solve the country’s unemployment and inflation problems. Similarly, technology can be implemented more to create employment opportunities and combat inflation. In my opinion, technology should be implemented to cut the cost of production and reduce the inflation rates. Recyclable energy, such as electricity and solar energy, should be utilized to reduce the cost of production from traditional and expensive fossil energy. Lastly, policies should be put in place to promote the GDP and thus promote employment rates for both college graduates and African-Americans in the United States.

References

Axelrad, H., Malul, M., & Luski, I. (2018). Unemployment among younger and older individuals: does conventional data about unemployment tell us the whole story? Journal for Labour Market Research, 52(1). https://doi.org/10.1186/s12651-018-0237-9

Bredin, D., & Fountas, S. (2018). U.S. inflation and inflation uncertainty over 200 years. Financial History Review, 25(02), 141–159. https://doi.org/10.1017/s0968565018000045

Kalsum, U., Hidayat, R., & Oktaviani, S. (2020). The Effect of Inflation, U.S. Dollar Exchange Rates, Interest Rates, and World Oil Prices on Gold Price Fluctuations in Indonesia 2014 – 2019. Journal of Business Management Review, 1(3), 155–171. https://doi.org/10.47153/jbmr13.342020