Free Cash Flow and Equity Case Study Essay: Mini Case 4 Chapter 7 Week 3 FIN 650

Your employer, a midsized human resources management company, is considering expansion into related fields, including the acquisition of Temp Force Company, an employment agency that supplies word processor operators and computer programmers to businesses with temporarily heavy workloads. Your employer is also considering the purchase of Biggerstaff & McDonald (B&M), a privately held company owned by two friends, each with 5 million shares of stock. B&M currently has free cash flow of $24 million, which is expected to grow at a constant rate of 5%. B&M’s financial statements report short-term investments of $100 million, debt of $200 million, and preferred stock of $50 million. B&M’s weighted average cost of capital (WACC) is 11%. Answer the following questions:

Describe briefly the legal rights and privileges of common stockholders.

The legal rights and privileges granted to common stockholders involve the right to transfer ownership, the right to sue actions, ownership, voting power, and the right to evaluate corporate documents.

What is free cash flow (FCF)? What is the weighted average cost of capital? What is the free cash flow valuation model?

FCF refers to the cash generated by a company after accounting for cash used to support its capital assets. WACC (Weighted average cost of capital) refers to the average rate a company is expected to pay to finance its assets. The free cash flow valuation model consists of two approaches, one is based on discounting projected free cash flow at WACC in order to identify a firm’s total value. The second approach to the Free cash flow valuation model is based on discounting the free cash flow to equity in order to identify the value of the firm’s stockholders’ equity (Fernandez, 2010).

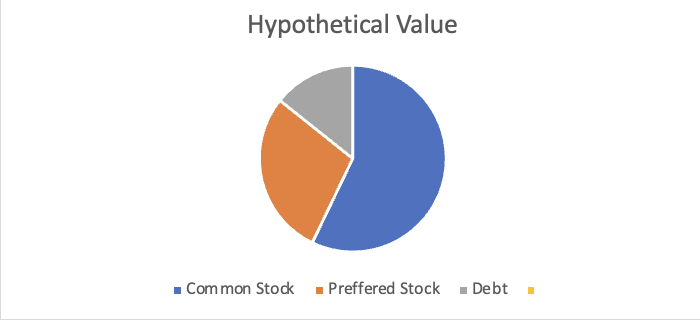

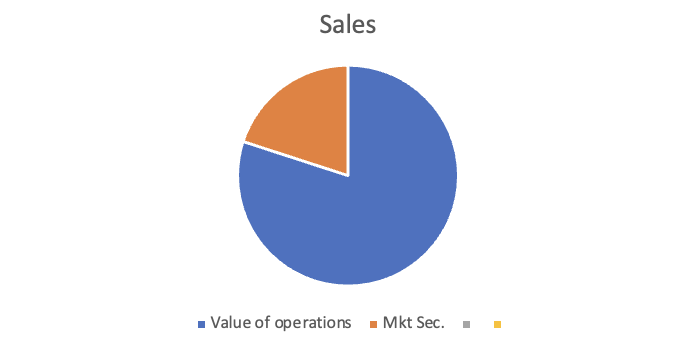

Use a pie chart to illustrate the sources that comprise a hypothetical company’s total value. Using another pie chart, show the claims on a company’s value. How is equity a residual claim?

Figure 1 below is a pie chart that represents the sources that comprise a hypothetical company’s total value while figure 2 represents claims on a company’s value. Equity involves common shareholders as the real owners of a company. The common stakeholders have the right to claim assets after preferred stakeholders and all creditors have been satisfied.

Figure 1: Hypothetical total value of a company

Figure 2: Claims on a company’s value

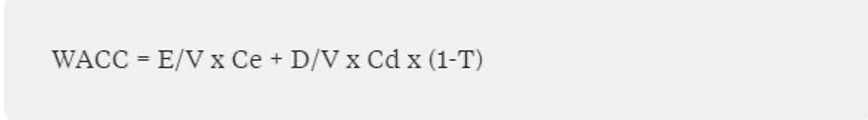

Suppose the free cash flow at Time 1 is expected to grow at a constant rate of forever. If , what is a formula for the present value of expected free cash flows when discounted at the WACC? If the most recent free cash flow is expected to grow at a constant rate of forever (and ), what is a formula for the present value of expected free cash flows when discounted at the WACC?

Figure 3 below represents the formula for the present value of expected free cash flows when discounted at the WACC. E represents value of equity, D represents value of debt, Ce represents cost of equity, Cd represents cost of debt, V is the value of D + E, and T represents the tax rate. Figure 4 represents the formula of the most recent free cash flow when expected to grow at a constant rate where NPV stands for the net present value where PV represents present value.

Figure 3: formula for the present value of expected free cash flows when discounted at the WACC

Figure 4: Formula of the most recent free cash flow when expected to grow at a constant rate

![]()

Use B&M’s data and the free cash flow valuation model to answer the following questions:

(1)

What is its estimated value of operations?

The estimated value of operation based on B&M’s data will involve operating cash flows after the removal of the capital expenditures. The estimated value of the operation is $24 million.

(2)

What is its estimated total corporate value? (This is the entity value.)

The formula for entity value will involve short-term investments ($100 million) plus debt ($200 million) plus preferred stock of ($50 million) minus free cash flow ($24 million) which amounts to $326 million

(3)

What is its estimated intrinsic value of equity?

The estimated intrinsic value based on B&M’s data refers to the present value in regard to estimated future cash flows. This is calculated by calculating 5% of $24 million (free cash flow), which amounts to $1.2 million.

(4)

What is its estimated intrinsic stock price per share?

The estimated intrinsic stock price per share is identified by dividing the estimated intrinsic value of equity ($1.2 million) by the number of shares (10 million shares), which amounts to $0.12 million per share.

Potential Ethical Issues

The potential issues that may face the company from expanding into other related fields include unethical accounting, bribery and discrimination, cultural dimensions, and Privacy. The expansion may lead to conducting unethical accounting practices by stating inaccurate financial reports. The ethical unethical accounting issue can be mitigated via the usage of technology rather than human-generated reports. Bribery may involve exploitation within the organization based on the heavy workloads faced by businesses under Temp Force Company. In addition, the acquisition of Temp Force Company may lead to privacy issues as the computer programmers to be supplied to businesses can monitor employees’ activities (Russell, 2018). The privacy policy can be reviewed to ensure employees’ privacy is not monitored via technology. Regarding cultural dimensions, the expansion of the company may lead to accommodating more employees with different cultures that usually have their own customs. The company should focus on identifying benefits that can be integrated into diverse groups based on their customs.

The opportunities to promote ethical standards during the company’s expansion into other related fields including rewarding ethical behavior. Rewarding ethical behavior will promote an ethical culture within the organization. In addition, the expansion of the company provides an opportunity to train employees of acquired companies on the company’s code of conduct. The acquisition of companies will lead to an increase in the number of employees. In this regard, the company should aim to treat the employees better to build a trusting relationship. The company should aim to address issues relating to equity, diversity, and inclusion to help ensure ethical business performance.

References

Fernandez, P. (2010). WACC: definition, misconceptions, and errors. Business Valuation Review, 29(4), 138-144.

Russell, L. T. M. (2018). Ethical Issues of Small Business Owners: A Regional Perspective and a Conceptual Framework. KnE Social Sciences, 93-99.